New research from Adapt reveals the top trending categories of July 2022 and how they’ve shifted over the past year.

Summer is in the air. Consumers are spending more across the board; people are buying new furniture, enjoying outdoor and sport activities, pursuing new hobbies, and indulging at great restaurants. The world feels more open than it has in quite a while. It’s the first real summer break since 2019.

When compared to the previous year, the shifting in consumer trends are staggering.

#1 - Several categories - including grocery (both household and convenience) and department stores - are showing impressive double-digit growth in July 2022 in Online Shopping.

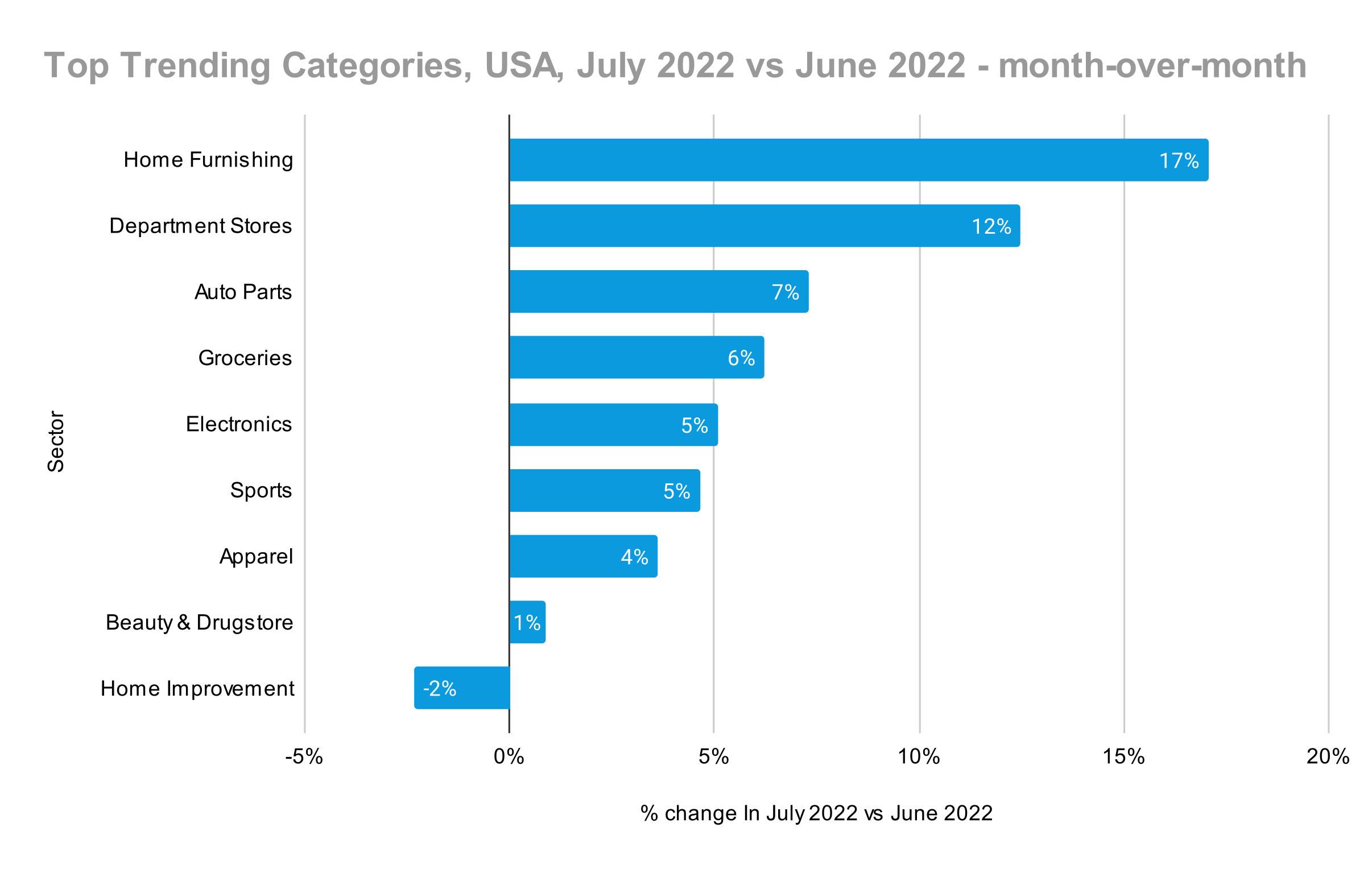

Overall, there has been an increase of 9% on average in online shopping in the USA in July ‘22 compared to the previous month, June ‘22.

#2 - Although July 2022 was a strong month for online sales - which saw continued momentum since the second quarter - the overall change compared to a year ago (July 2021) is currently -6%. This decrease reflects a market correction in online demand; stores have opened gradually during 2022 and consumers display quick shifts in shopping habits.

#3 - The most notable categories to take a hit during this period have been those that grew significantly during the Pandemic, such as Home Improvements, Sports, and Beauty & Drugstore. It is interesting to see how different consumer behavior is per sector, as well as the clear correlation between the success in digital channels to investing (or not investing) in technology and overall digital-approach.

1. The groceries sector Increased by ~6% in July, 2022. The relatively new consumer trend of ordering groceries online is still here and the immense investment by companies catering to this demand in fast delivery methods, same-day delivery, and such have paid off.

2. There has been a noteworthy trend of 4% year-over-year declines for the “Top 5” in the USA compared to the 11% year-over-year uplift for the “Top 5-10”.

3. Convenience stores trends have followed the overall increase, which is most likely explained by a large percentage of consumers enjoying summer, especially after two years of being mostly indoors. Accordingly, 7-Eleven and Couche-Tard have both seen growth in the double digits.

4. In general, inventory levels in the groceries sector are still high due to price increases. Additionally, there has been a shift in consumer preferences away from bulk purchases and towards buying in smaller quantities. This, coupled with the growing tendency of consumers favoring less quality food has led to an overall trend that sees consumers saving money and lowering their basket sizes. Lower than expected gas prices contribute nicely to growth, as well.

The department store sector increased 12% on average in July `22 compare to June `22. Despite the increase in macroeconomic pressures on consumer spending, there has been a shift that’s seen consumers heading back into stores to continue shopping. The trend of buying items online and picking up in store (BOPIS) together with adding more omnichannel options (such as self-service pickups and returns) also contribute to growth.

1. With physical stores reopened, it seems that a large portion of consumers are returning to buying in-person. This trend has caused shifts in consumer behavior in certain sub-categories, like make-up, for example.

2. There has been a massive decrease in the demand for pandemic-driven personal hygiene and disinfecting products such as face masks and hand sanitizers compared to last year. In addition to greatly reduced sales, businesses offering these products no longer enjoy the traffic from consumers coming to buy a face-mask (for example) and buying other items, too.

3. Out of stock of key items due to supply challenges contributed to decline.

4. Although sales for Sephora, CVS, Walgreens decreased between -7% to -10% compared to a year ago, Rite Aid remained resilient with no change in demand. This is likely explained by continued momentum online; all of these businesses recovered well in July ‘22, showing increases from ~1%-8%.

1. Demand in the home Furnishing category reflects a correction after surging during the pandemic. Compared to a year ago, most companies suffered from a 7-21% decline. Wayfair, specifically, was hit with 21% year-over-year decline.

2. Ikea was on top in July ‘22 with an impressive growth of 29% compared to June ‘22. Wayfair also enjoyed a sharp increase of 9%, possibly thanks to investing in new delivery methods (like participating in autonomous trucking pilot). The rest of the players in this category experienced significant growth, as well; Bed Bath & Beyond with +16% , Williams-Sonoma with +12% and Big Lots with an uplift of +5%. The boost against the general decline yearly trend is probably mainly due to increases in home repairs and renovations during the summer.

1. Best Buy fell by -16% year-over-year while other companies, including Apple, the sector showed small increases of around 2% compared to the previous year. As a result, the general trend for the category is mixed. To derive proper conclusions, it is more useful to dive into each of the sub-categories

2. Traditionally, the Electronics & Appliances sector has been highly correlated with consumer disposable income; in times of growth, spending goes up while recessions result in reduced spending. This effect partially explains Best Buy’s decrease. Amazon, on the other hand, continues to grow and grab even more market share.

1. There has been a decrease of 13% in online demand compared to one year ago. This category enjoyed very high demand in the Covid-19 pandemic but seems to have cooled in the aftermath.

2. July ‘22 saw a nice uplift of 5% in July ‘22 for The Home Depot compared to June ‘21, mainly helped by higher prices and steady demand for do-it-yourself and home improvements, which picks up in the summer months. Lowe's, the other major player in the sector, showed a slight decrease of 3% in July ‘22 compared to June ‘21.

1. There has been a significant decrease in spending on apparel in the US. According to this research, 47% of US adults are spending less on apparel due to rising prices.

2. Inventory in this category is very high, as many retailers were stuck with import surpluses, leading to challenges with moving discounted clearance merchandise - especially since consumers often prefer new season products. There was also a shift in consumer preferences within the apparel sector from sports and home clothes to office and outdoor clothes.

3. Lululemon showed an impressive uplift of 20% compared to a year ago. Others, like American Eagle, declined by 19%. Gap, catering to lower-income consumers was particularly affected by the shift to party dresses and office clothes, which is not the company’s niche. For Gap, this unfavorable trend in combination with rising inflation led to a decrease of 13% compared to July ‘21. Fortunately for both American Eagle and Gap, however, July ‘22 has resulted in recovery for these businesses with a 3% increase.

A blazing light at the end of the tunnel. Consumers appear to be mostly resilient to financial turmoil, online shopping continues to bloom, and pandemic consumer shopping behavior remains. The combination of these trends creates a great opportunity for businesses looking to continue growing online sales in the coming months.

Further read and resources -

A more detailed list with the leading Top 100 retail websites in USA on the rise is below.

If you are interested in more detailed data, or have inquiries about how this research can be used to increase sales in your business, kindly email us to research@adapt.online

Click to get a free demo of your company and watch how it works.

Schedule a live demo and see in action how Adapt increases sales.

Click to get a free market analysis report of your company and watch how it works.

Click to get a free retail market trends report of your industry and watch how it works.