New research from Adapt reveals the top trending categories of August 2022 and how they had shifted over the past year.

Fall is in the air. Amazing to see how consumer trends have impacted retail companies in the last month.

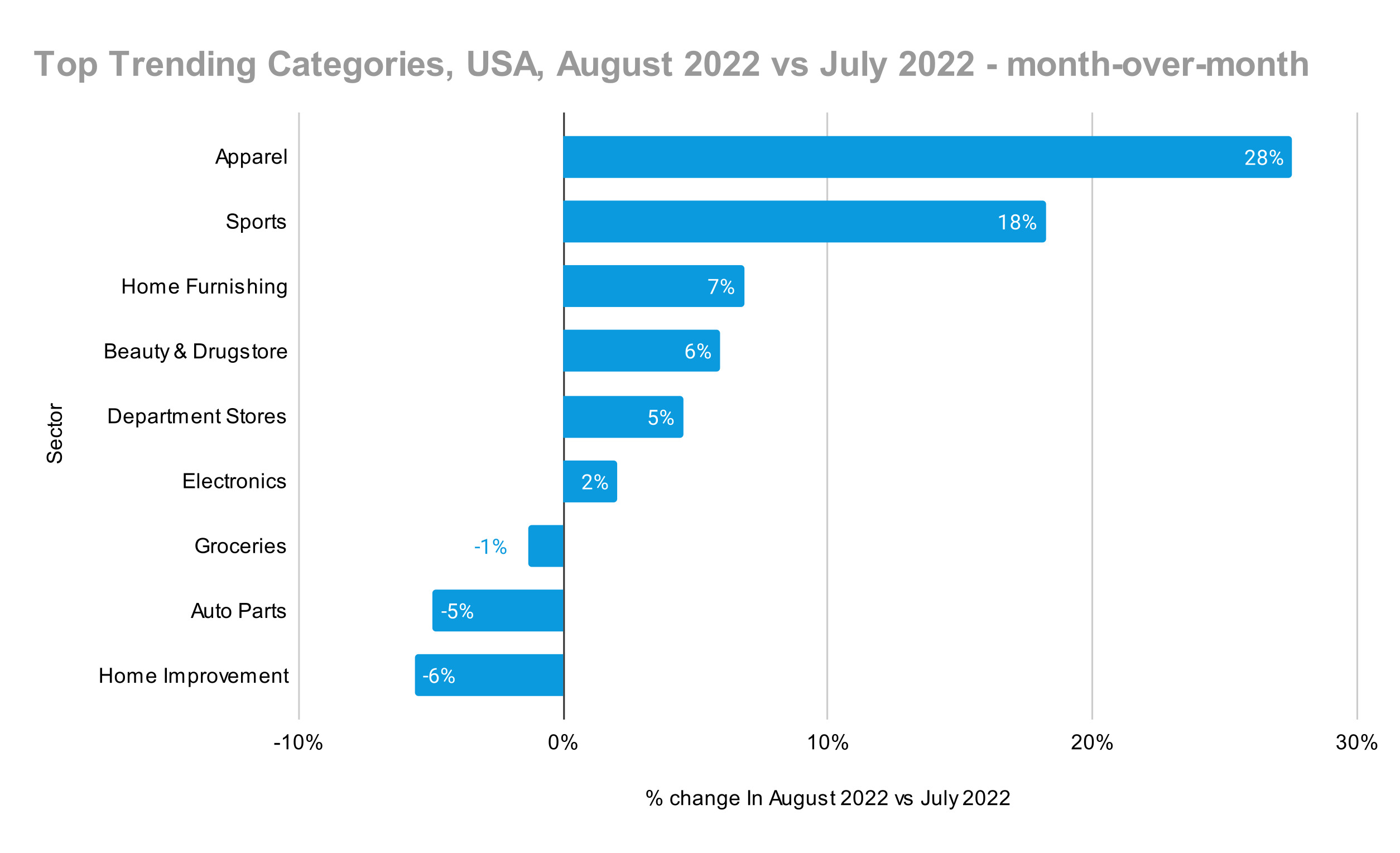

#1 - Two categories with many similarities - Apparel & Sports - are showing very impressive growth in August 2022 in Online Shopping.

Overall, there has been a slight decrease of ~1% on average in online shopping in the USA in August ‘22 compared to the previous month, July ‘22.

#2 - At the top of the grocery sector there is a lot of turmoil. While the traditional groceries falls by 1%, many market leaders are investing in new categories, looking to achieve growth elsewhere.

#3 - The department store sector continues its momentum with half of the Top 10 companies showing a very impressive growth.

#4 - A growing trend of consumers signing up for more streaming services, is creating a market opportunity for Electronics. Consumer interest is shifting from focus on large screens to getting high-end audio systems.

#5 - In the Beauty & drugstore sector, RiteAid is moving to grab more market share from Top 4 players, with impressive online growth

#6 - Two categories that fall this month the most are Home Improvements & Auto, as people are going back to work and school and have less free time to invest in improvements of home and vehicles alike. It is interesting to see how the sports category, which suffered a hit the month before, is gaining back momentum, while also enjoying the overall uplift in apparel, from casual to formal.

1. The groceries sector fell slightly by ~1% in August 2022. As a result, we see in September 2022 many classic grocery companies heavily investing into entering new categories - healthcare, manicure, toys, and more.

2. At the top of the grocery sector there is a lot of turmoil.

The department store sector increased 6% on average in September `22 compare to August `22. With half of the Top 10 companies showing a very impressive growth.

1. All Top 4 sector leaders - CVS, Walgreens, Ulta & Sephora - are increasing, 6% on average.

2. RiteAid is moving to grab more market share from Top 4 players, with impressive online growth of >20%. RiteAid has a long way to build-up before then can claim sector leadership, but they are closing the gap rapidly, with double-digit growth to sales in the last 6 month.

3. Good Neighbor Pharmacy is still struggling to get online sales growing consistently, but as almost the whole sector is rising there is much drive to improve and enjoy sector's growth.

1. IKEA continues to lead the sector with strong performance both in volume and in growth rate.

2. Wayfair drops slightly by 7%, reflecting the decline in consumers demand for buying furniture online after the end of the Pandemic.

1. Best Buy falls ~13% compared to last year, with the strongest driver being sales decrease in home theater equipment.

2. However, there is a growing trend of consumers signing up for more streaming services, which is creating a market opportunity - for BestBuy - and for other players.

3. Consumer interest is shifting from focus on large screens to getting high-end audio systems. It is recommended for big box Electronics retailers to focus their marketing efforts there, where potentially a higher growth and higher margins can be achieved.

1. Home Improvement drops 6% in August 2022, but there is light at the end of the tunnel, especially for online-focused companies, as the search volume increasing significantly in this category.

2. Consumers are moving product research online - with 26% more home improvement online searches in the past year. Kitchen-related renovation lead the category's demand.

3. 44% of Consumers say they are currenly planning a renovation, but how to move them from planning phase to buying phase is the big question here.

3. With AR successfully implemented in buying new Home products, Adapt Research team claims there is much room for AR in renovation - instead of breaking walls, tiles, and cabinets - one can use AR technology to visualize, plan, and buy the products needed to bring the renovation project to life. It can reduce the time-to-buy for many clients, and a Home-Improvement company partnering with an AR-startup can potentially land-slide the whole renovation planning market & gain a lot of public attention. Similar to what Nike, Under-Armour, and many other sport brands have done successfully with fitness apps. The technology is ready for it.

1. Apparel is booming, in every way you look - Brands, Retailers, Sports, Luxury, Department - you name it.

2. After a great summer people waited two years for, they are now eager to get back to work, to start a new year in school, or to adjust to changing weather - with new garments and shoes.

3. In the Luxury sector Dior has left all competitors, such as Burberry, Gucci, behind with a surge in sales, profits, and operational excellence.

Further read and resources -

A more detailed list with the leading Top 100 retail websites in USA on the rise is below.

If you are interested in more detailed data, or have inquiries about how this research can be used to increase sales in your business, kindly email us to research@adapt.online

Click to get a free demo of your company and watch how it works.

Schedule a live demo and see in action how Adapt increases sales.

Click to get a free market analysis report of your company and watch how it works.

Click to get a free retail market trends report of your industry and watch how it works.